-

Posts

15,298 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by Andrew Reid

-

April fools https://www.eoshd.com/news/steve-huff-quits-camera-reviews-for-communicating-with-the-paranormal/

-

EOSHD interview with Panasonic manager about the GH6

Andrew Reid replied to Andrew Reid's topic in Cameras

Blimey blog posts were a lot shorter back then! Not as short as a social media post, but not a book either. Fond memories. -

Had the opportunity to interview Masanori Koyama, product planner for the GH6 and S1H: https://www.eoshd.com/news/interview-with-panasonics-masanori-koyama-product-planner-for-the-gh6/ Hope you enjoy.

-

Steve's spirit box app should have a sponsor like Kessler and accompanying pocket dolly. Until it all goes wrong, the spirit jokes about his balding head and he ends up smacking the ghost in the mouth Will Smith style.

-

They will need to rotate the James Webb Telescope 180 degrees and point it back at earth to spot those.

-

Max Tech pivoted from cameras to phones. Steve went Skyping with ghosts Top video has 11 million plays. So the question for EOSHD is, what should I pivot to now... Special lenses that can spot elven spirits in the woods?

-

Turns out we've been wasting our time with Wifi apps for the EOS R5. This one is number 88 in the Utilities chart on Apple App Store Only has 2.7 rating however and the developer's name is all lower case "chris rogers" which is always a bad sign.

-

EOSHD YouTube: A lot of Oscar 2022 nominated films using vintage lenses

Andrew Reid replied to Andrew Reid's topic in Cameras

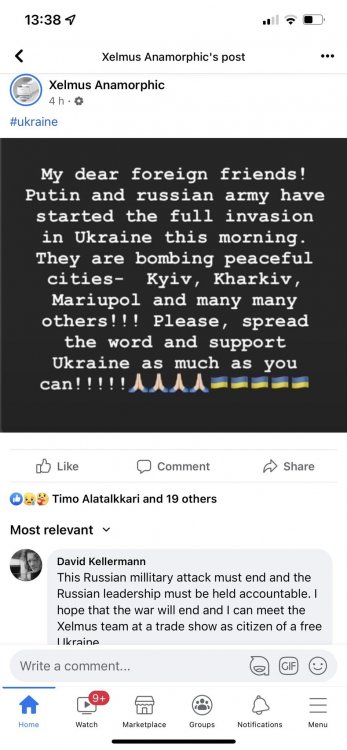

It was sponsored by a massive Crypto dot com ad as well.... Which is ironic considering crypto's deep involvement in money laundering, illegal activity, mafia states and governments, they are basically Putin's best friend. -

All this time I had no idea https://www.youtube.com/c/huffparanormal/featured

-

Mediocrity is the new gold standard.

-

Just bought a GFX 50R by the way 😆

-

Yeah into the consumerism swamp we go. A big shame for our culture, or what's left of it.

-

I can see what you mean but from my perspective it does indeed matter other the guy is doing, especially as they are fucking the life out of the internet as a viable business, as well as normalising bribery and reducing the viability of my business model at EOSHD, at the same time as taking 80% of my audience away. The whole internet is only going to be fit for the dustbin and we won’t have any community left.

-

I am demotivated. In fact, I have come to believe it is the audience and consumers who are to blame for the current situation, as much as the shills. Speaking not about you guys but more generally in terms of the interest in cameras, perhaps best epitomised by Philip Bloom's followers - A lot of people simply don't value the principals which drive a free and open internet. A lot don't even understand what they are. As Steve said in his video, he started reviewing cameras as a hobby. When a hobby stops being fun there is no point to it, or it becomes a chore to keep up with paying the bills which is what EOSHD has currently become to me. The reason the ad dollars and shills have won the entire internet is because followers let them.

-

These posts always go badly and end up in a shit show. This one will eventually too. Just watch...

-

Sorry to hear it. I stopped using Vimeo a while back and went to YouTube for exactly this reason. Felt like they were holding a gun to my head that could go off at any time.

-

-

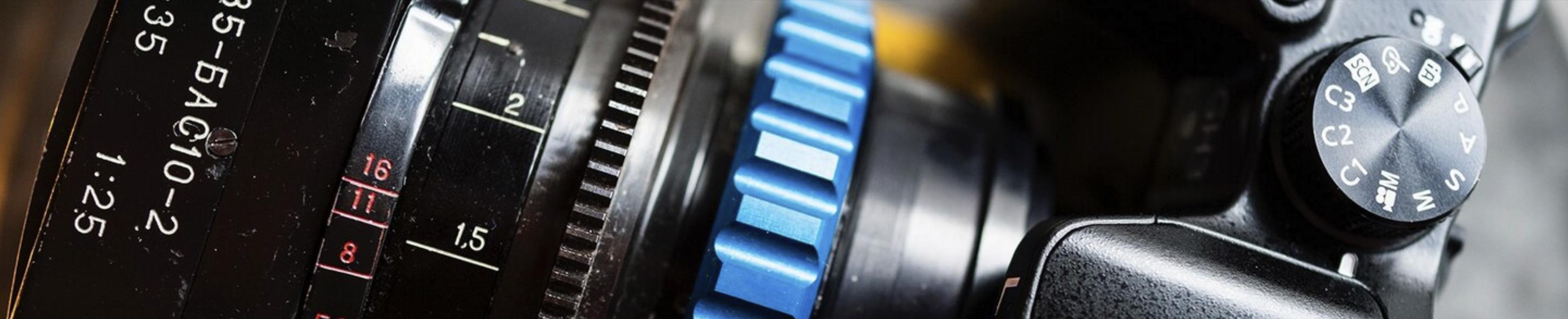

First impressions of the Panasonic GH6 I have on loan

Andrew Reid replied to Andrew Reid's topic in Cameras

-

First impressions of the Panasonic GH6 I have on loan

Andrew Reid replied to Andrew Reid's topic in Cameras

Yes, the intro no longer is appropriate given today's events. Going to re-do the video and post it later when had more time with the camera. -

First impressions of the Panasonic GH6 I have on loan

Andrew Reid replied to Andrew Reid's topic in Cameras

Pretty close in low light I'd say. GH6 is worth upgrading to I think. Will do a proper comparison between those too. As I need to decide whether to keep my GH5S or sell. -

Not a review yet, just initial impressions.

-

What impact if any does Color Chrome Effect have on this in the Fuji menus? Is it possible Fuji's processing by default blurs the chroma channel so that dialling in certain film simulation settings brings it back and changes the look? It must be on purpose they have done this.

-

I prefer the OM-1 body design and huge EVF, in terms of having some photography DNA aka Leica, it does well, and AF system looks promising. I prefer the specs sheet of the GH6 for video and anamorphic shooting. But I am so far beyond just specs these days.

-

It doesn't have a quad bayer sensor. It has some sort of quad pixel AF. Not looked into that too deeply yet as still waiting for somebody who isn't a complete shill to handle the OM1.

-

There is absolutely no doubt it is a sweetheart Sony deal not a public tender. The giveaway is how specific the tender is. "Eye tracking. 24-200 equivalent lens. 15 frames per second/no blackout." A tender shouldn't be this specific about a compact camera if they really had any intention in making a deal with companies other than Sony or even hearing from all the camera companies at all.